Key Points

- Three copper stocks are setting up a way for investors to get additional exposure to the EV and AI wave shortly.

- Analysts think these companies will still have an average double-digit EPS growth for the next 12 months.

- Price targets and price action have much more to say about how high these stocks could go.

- 5 stocks we like better than Hudbay Minerals

Investors need to consider some of the world's most critical trends if they want to expose their portfolios to global growth. Some of these current trends are electric vehicles (EVs) and artificial intelligence components, which go beyond semiconductor and technology stocks.

These vital industries are helping the world move forward. However, with new players popping up nearly every day, many investors follow the hype behind these industries relatively blindly. But trying to pick the winner among dozens of potential companies or spreading your eggs across many baskets, hoping for one to win, is akin to venture capital investing. That's not the goal here.

A surefire way to guarantee a return on investment is by backing the necessary materials and industries that allow EVs and AI to take off. Lithium already had its run in popularity, giving copper a spot in line to become the next hot issue, with stocks like Ero Copper Corp. NYSE: ERO, Hudbay Minerals Inc. NYSE: HBM, and Newmont Co. NYSE: NEM.

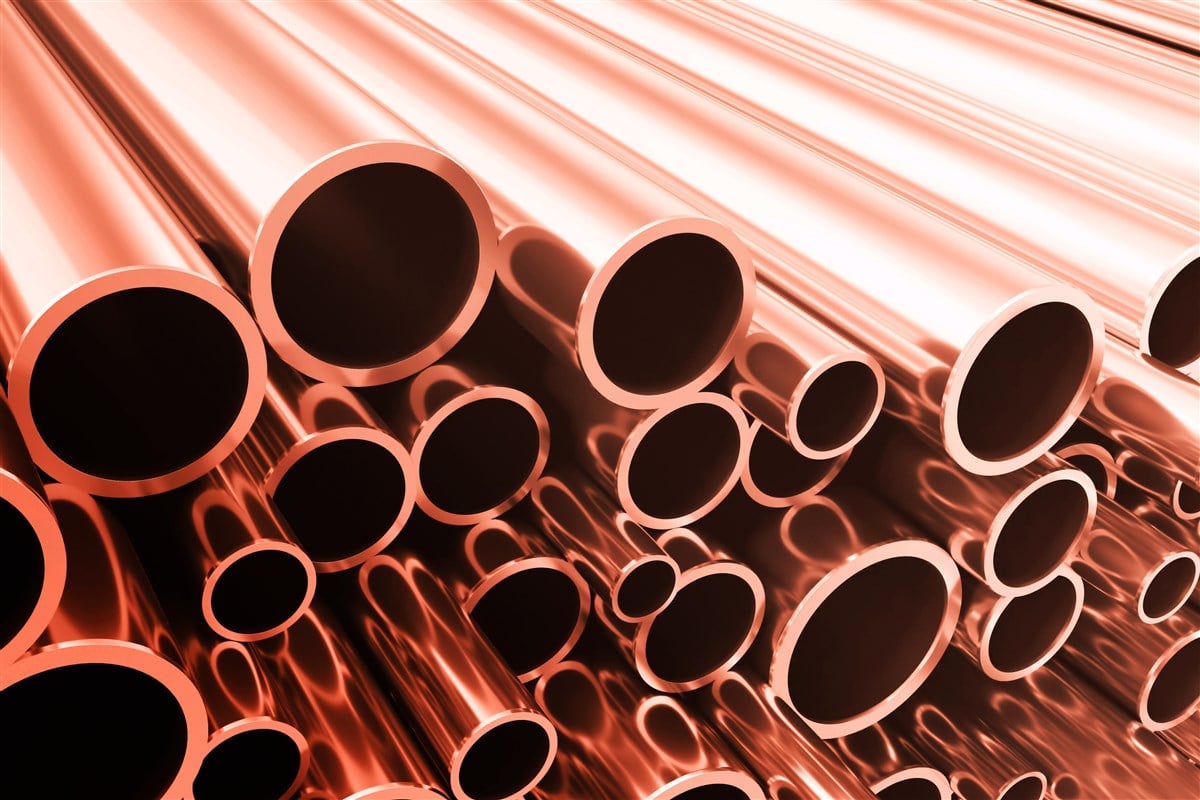

Why Copper Matters in These Trends

Copper is a critical material for power distribution in data centers that house the most advanced computers dealing with machine learning and other AI computing processes. It's also a crucial component in the batteries that guarantee EVs work and can scale to take on the combustion engine's reign.

Prices for the commodity nearly doubled this year, going from $3.6 a pound in the fourth quarter of 2023 to roughly $5.1 a pound today. This level represents a new five-year high, surpassing the previous ceiling of $4.9 a pound in the first quarter of 2022.

This stratospheric rally in copper represents rising demand from businesses and traders looking to ride the inevitable wave that will come off the growing adoption of EVs and AI.

Investors can check the commitment of traders' reports (COT) for copper futures and note how managed money has been added to copper futures since February 2024. The last time the COT showed managed money taking this large an interest in copper was May 2020, roughly a year before copper prices reached an all-time high.

Hudbay is Looking to Repeat History

HBM

Hudbay Minerals

$9.76 -0.01 (-0.10%) (As of 05/31/2024 ET)

- 52-Week Range

- $3.94

▼

$10.49 - Dividend Yield

- 0.10%

- P/E Ratio

- 42.43

- Price Target

- $10.21

If the COT indicates the likely future price of copper, it should also be for Hudbay stock's path. Now trading at a new 52-week high, bullish momentum is definitely on its side, and Wall Street analysts aren't debating it.

With an earnings per share (EPS) growth projection of 82.9% in the next 12 months, Hudbay is looking to take the industry by storm, and those at Jefferies have an initial ceiling in mind.

Slapping a $13 a share price target is a start, as it calls for a 26.3% upside from where the stock trades today. Judging by how the Vanguard Group raised its stake in Hudbay stock by 3.2% as of May 2024, bringing its total investment to $60.9 million, the actual ceiling could be much higher.

When Size Matters, Count on Newmont

$41.94 +0.05 (+0.12%) (As of 05/31/2024 ET)

- 52-Week Range

- $29.42

▼

$45.92 - Dividend Yield

- 2.38%

- Price Target

- $48.36

Being a $ 48.7 billion company has its perks, one of which is being able to afford a dividend payout. Compared to Hudbay and Ero, which don't have a market capitalization larger than $10 billion and pay no dividends, Newmont offers investors a 2.3% annual dividend yield.

In addition to this income, investors can rely on analyst projections for 34.2% EPS growth this year, keeping Newmont at the top of the industry, which is only expected to see 28.2% EPS growth on average.

BMO Capital Markets analysts see a valuation of up to $54 a share for Newmont. To prove these projections right, the stock would need to rally 23.5% from its current level, an attractive ceiling despite reaching 95% of its 52-week high.

As the role of copper becomes more well-known across markets and how Newmont's upside could be crystalized, bearish traders decided to pass on this one. Newmont's short interest declined 7.2% over the past month to show this tendency.

Ero's Discount at Checkout

$21.30 -0.31 (-1.43%) (As of 05/31/2024 ET)

- 52-Week Range

- $11.35

▼

$24.38 - P/E Ratio

- 32.77

- Price Target

- $24.00

Compared to the materials sector, Ero Copper trades at a massive 73.5% discount when measured on a P/E basis. The company's 36.7x P/E falls below the sector's 139x higher premium despite having EPS expectations of 91.2% growth this year.

Despite this discount, the stock still attracted enough bullish momentum to trade at 98% of its 52-week high. Traders are willing to overpay using a different metric, knowing how important Ero's copper could soon become in the market.

A price-to-sales (P/S) of 5.7x places Ero above Newmont's 3.7x and Hubday's 1.8x. Knowing that stocks typically command a premium and trade near 52-week highs for a good reason, short interest in Ero stock declined by 20.6% over the past month, showing investors that bears aren't looking to slow the stock down.

Before you consider Hudbay Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudbay Minerals wasn't on the list.

While Hudbay Minerals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report